AI will boost efficiency in the insurance industry, with underwriting and risk profiling seen as the area of the value chain most ripe for AI disruption, according to GlobalData surveying. Meanwhile, data from Lloyd’s finds financial services providers are already enjoying improved productivity and enhanced customer experiences thanks to the implementation of AI.

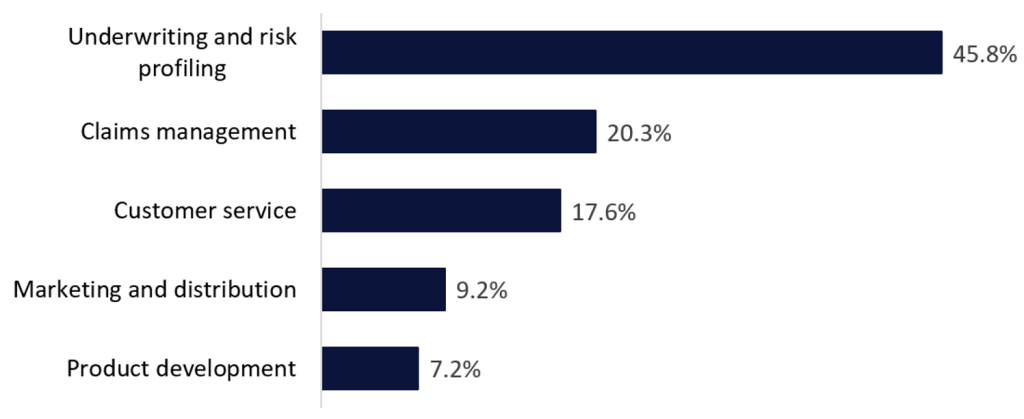

According to a poll conducted by GlobalData on Verdict Media sites in Q3 2025, which garnered over 150 responses from industry insiders, 45.8% of respondents believe underwriting and risk profiling is the area of the insurance value chain that will be most positively impacted by AI. Claims management and customer services will be the next areas, attaining 20.3% and 17.6% of responses, respectively.

Which area of the insurance value chain will be most positively impacted by AI? Q3 2025

The incorporation of AI along the various areas of the insurance value chain is already having tangible outcomes; driven by an increase in adoption rates, while the technology has continued to evolve quickly. According to the latest Lloyds’ Financial Institutions Sentiment Survey (FISS), which surveys over 100 leaders across the UK’s largest banks, asset and wealth managers, insurers, and financial sponsors, 59% of financial institutions have improved their productivity from AI—up from 32% in 2024. In addition, 33% of financial institutions report seeing an enhancement in their client experience, compared to 14% a year prior.

AI is transforming the insurance industry by automating and streamlining key processes, reducing effort and time of labour-intensive tasks, and improving accuracies. For instance, the speed and precision of AI in pattern recognition means that risks can be quantified more accurately and policies underwritten faster. Meanwhile, the automation of claims processing can lead to reduced settlement times for consumers, who at the same time, will be able to access customer support 24/7. According to GlobalData’s 2024 Emerging Trends Insurance Consumer survey, 30.4% of UK consumers would be very or quite comfortable for an AI tool to determine their insurance premium, while 28.4% would be comfortable for an AI tool to determine the outcome of a claim. This highlights there is still scope to improve trust in AI among consumers.

The benefits of incorporating AI into different areas of the value chain will translate into increased efficiencies, improved customer experience, and greater profitability margins. Tangible outcomes perceived by insurers and other financial services providers will lead to an increase confidence in AI. Similarly, customers’ confidence will also gradually increase as they become more accustomed to interacting with AI tools. A rise in confidence in AI will drive investment, but insurers must be mindful that there is still the need for human touch.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData