It is clear that industry insiders believe we are far off AI taking over job roles and being unchecked as insurers will be liable for any false information or advice they give to customers.

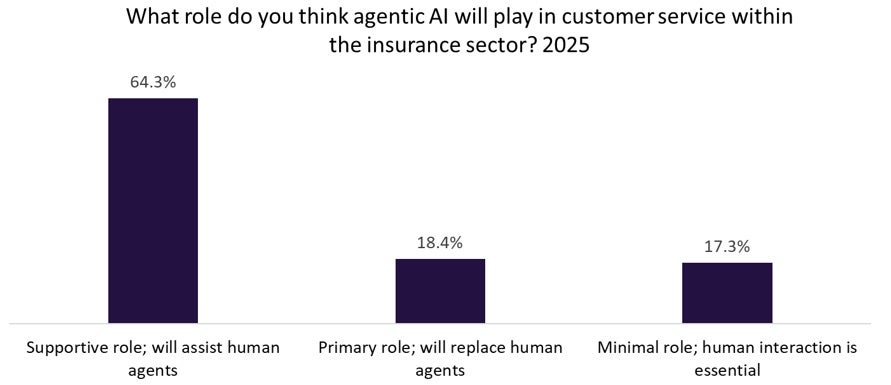

Customer service is one area where AI is already having an impact on the insurance industry. Instantaneous responses and 24/7 availability are huge plus points that can significantly improve the level of customer service. Data from a poll conducted on Verdict Media sites found that nearly two thirds (64.3%) of respondents believed agentic AI will have a supportive role with humans in the background. A much smaller proportion (18.4%) felt it would replace humans, which suggests this is a long way off at present.

It is clear from the 2024 Emerging Trends in Insurance Survey that consumers also are more comfortable using AI if there is a human agent they can be put through to if need be. It found that 42.9% of those not comfortable using AI (for a quote on premiums in this case) would be more comfortable with it if they could be put through to a human agent if they were not satisfied with the outcome. This was the most popular factor that would improve a consumer’s confidence. This emphasises that consumers and industry insiders are aligned on the need for AI and insurance agents to work together for the foreseeable future.

The rise of agentic AI has increased the possibilities within AI in insurance. Critically, agentic AI has the ability to make decisions in real time and is not just giving responses based on a set of preloaded instructions. This means it has a better capability of answering customer issues in a live chat situation. This can therefore create a very powerful customer service tool for insurers.

It is clear from GlobalData‘s surveys and polls that agentic AI will have a big impact in customer service which, for the time being at least, will be alongside human agents. Experts checking responses or being around in the background in case customers are not satisfied with the AI response is critical to a successful customer service process.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData