UK term assurance customers are generally averse to sharing the results of predictive genetic tests with their life insurer according to GlobalData’s 2022 UK Insurance Consumer Survey. As per the same survey, whole of life assurance customers are slightly more open to sharing these results.

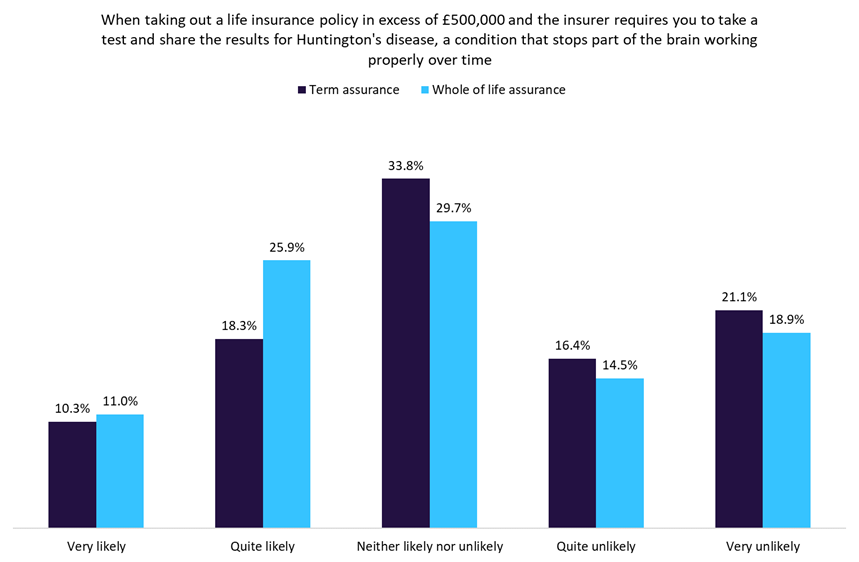

One question posed in the survey concerned reporting the results of a test for Huntington’s disease when purchasing a life insurance policy worth over GBP500,000. 28.6% of UK term assurance customers indicated that they are (to some extent) likely to share these results, compared to 37.5% who are not. By comparison, 36.9% of whole of life assurance customers appeared willing to share this information, compared with 33.4% who are not.

According to the Association of British Insurers’ Code on Genetic Testing in Insurance, this is the only reason an insurer may require a customer to reveal the results of a genetic test. For whole of life customers, sharing these results arguably makes more sense, as insurers cannot deny the policy and thus doing so would guarantee peace of mind that the payout will arrive when the time comes. It would also help keep premiums slightly lower, as one possibility of serious illness and premature death has been ruled out.

How likely would you be to consider sharing your predictive genetic testing data with a life insurer in the following scenarios?

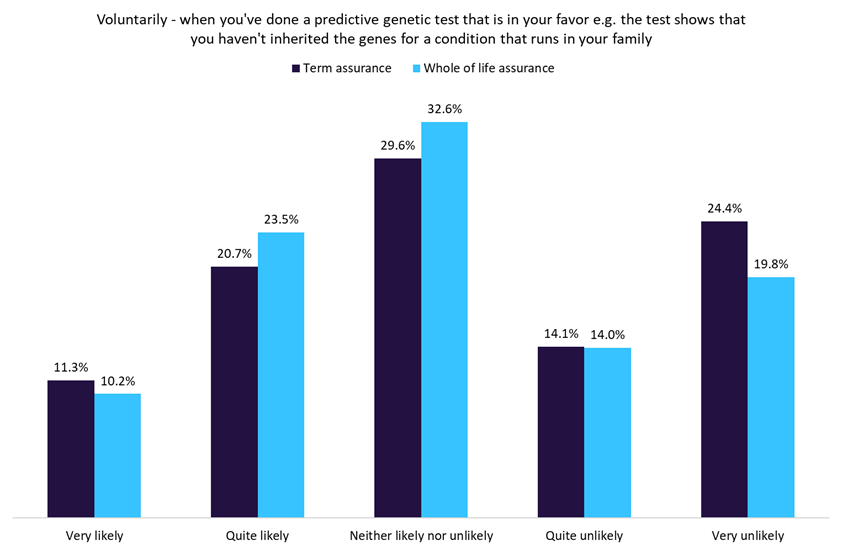

Another question in this survey pertained to consumers voluntarily giving genetic test results to an insurer if they are in their favor. In a similar vein to the previous question, term assurance customers are more against this (32.0% likely against 38.5% unlikely) compared to whole of life customers (33.7% likely against 33.8% unlikely). Indeed, the survey found an almost equitable split between those who would be willing to share the information, those who are unsure, and those who are unwilling.

This is perhaps indicative of the connotations these tests can have, as well as the implications using these tests can have on both insurers and their customers. Predictive genetic tests create a range of regulatory and ethical challenges, notably genetic discrimination. Yet as tests become more reliable – and care and treatment for illnesses become more effective – perhaps the stigma attached to genetic tests will fade. This may coincide with more advanced risk analytics used by health insurers, creating a fairer approach to the use of these tests.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData