GlobalData finds that over 40% of gig-economy delivery workers remain uninsured while on the job. As flexible, on-demand models continue to scale across food delivery and courier services, insurance offerings built around traditional employment are increasingly misaligned.

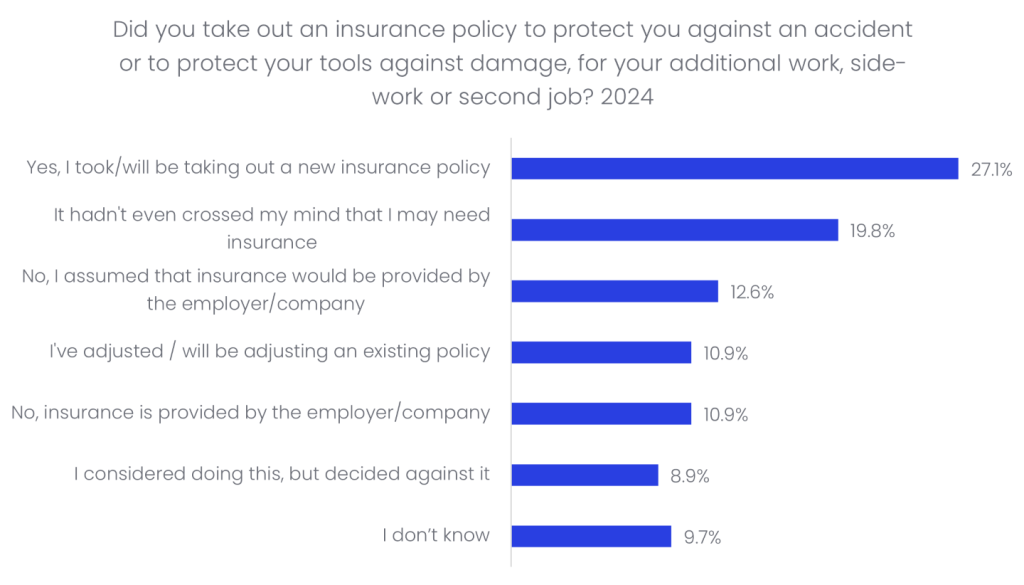

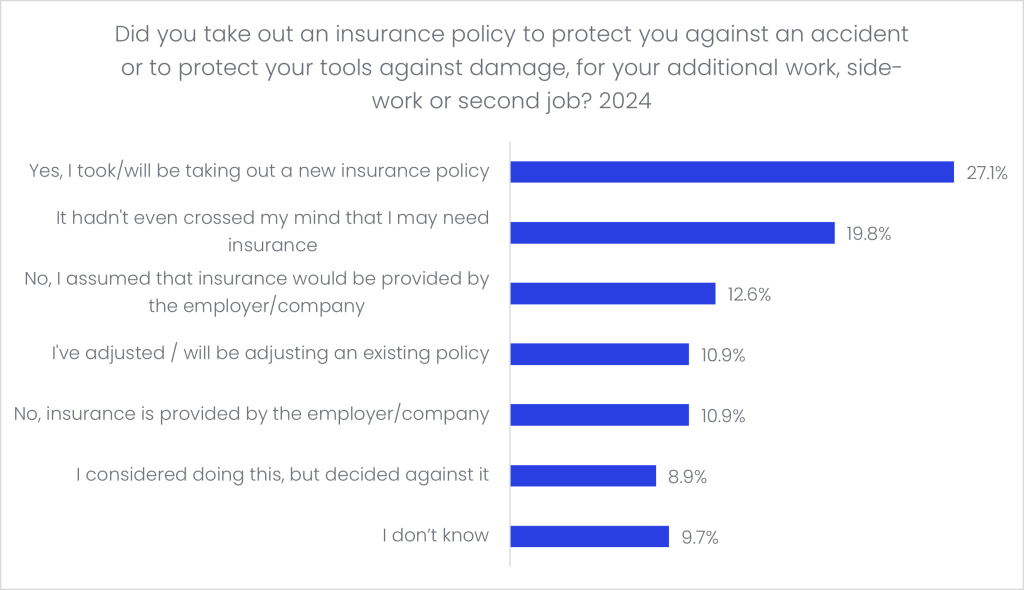

According to GlobalData’s 2024 UK Insurance Consumer Survey, engagement with insurance among gig workers remains lifted and inconsistent. Only 27.1% of delivery service workers reported taking out or planning to take out a new insurance policy, 10.9% adjusted an existing policy, and 10.9% had insurance provided by their employer/company. A significant proportion of respondents remain uninsured or inadequately covered. 19.8% sated that it had not crossed their mind that they might need insurance, while 12.6% assumed insurance would be provided by their employer/platform. A further 8.9% actively decided against purchasing insurance. These findings highlight that underinsurance is driven as much by misunderstanding and log engagement as by cost considerations.

Superscript is helping close this protection gap with a dedicated e-bike insurance product for couriers and delivery riders, developed in partnership with Sundays Insurance; a specialist bicycle insurer. Built specifically for riders using e-bikes for delivery work, it includes third-party liability and personal accident cover which provides protection while riders are actively on the job. Distribution will initially run through Superscript’s delivery-partner network in major UK cities, focusing on riders who are often underserved by personal policies and by traditional commercial insurance, which is typically structured for fleets or other vehicle categories.

Superscript’s e-bike insurance launch provides a clear example of how data-led insight into a gig worker behaviour can inform effective product design. By addressing misconceptions around employer-provided cover, reducing engagement barriers, and offering specialist protection through a digital platform, the initiative demonstrates how insurers and brokers can close persistent protection gaps, while unlocking growth opportunities within an expanding market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData