Professional advice and fears surrounding new technology (such as AI) are key cyber insurance policy triggers among SMEs as per a GlobalData survey. As the market becomes more preventative, specialised cyber policies may reduce the barrier to entry and help provide adequate protection for SMEs.

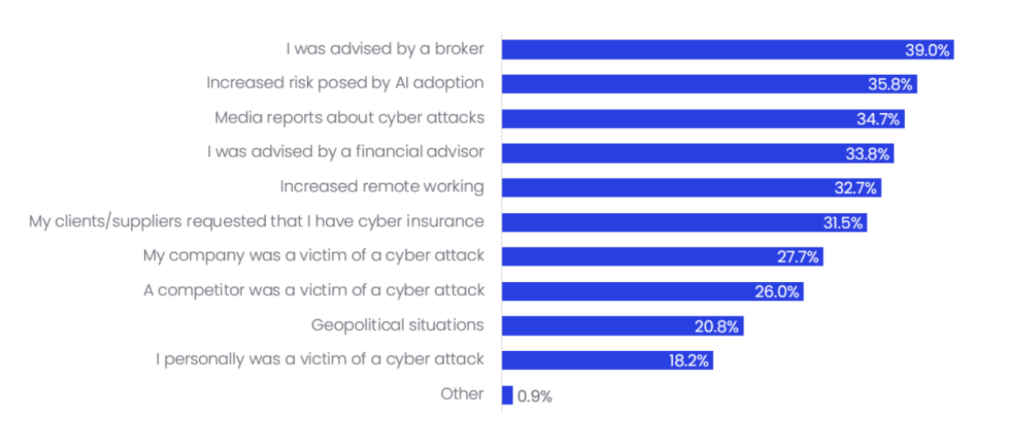

According to GlobalData’s 2025 SME Survey, professional advice is the most important driver prompting global SMEs to take out a cyber insurance policy. Being advised by a broker is the single most important factor (39%), while receiving advice from financial advisors was cited by 33.8% of respondents. However, SMEs are also wary about the increased risks posed by AI adoption, citing this as the second most important consideration (35.8%).

What was the trigger for purchasing cyber insurance? 2025

Source: GlobalData’s 2025 SME Survey.

The rapid spread of AI and its integration across all industries is making SMEs feel uneasy and anxious about the technology, perceiving it may pose a significant risk. Given that many standard cyber policies do not mention AI cover, there could be a gap between what clients expect from their policy and what the policy actually covers.

Typically, standard cyber policies exclude losses related to a business’s own AI tool giving erroneous outputs (such as quoting the wrong information in a chatbot) or litigations arising from biased data from AI-derived algorithms. In contrast, cyber insurance policies commonly cover losses from AI-powered hackers.

Brokers and financial advisers are uniquely positioned to assess clients’ risks and needs and match them to products that meet their requirements. For clients seeking protection against AI risks, they should consider offering them cyber insurance policies with add-ons that explicitly cover AI-related incidents; otherwise, they should offer them specialist policies alongside cyber insurance.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMeanwhile, the market is becoming increasingly more preventative, with professional advice and external factors playing a stronger influence on SMEs’ purchasing decisions when it comes to cyber insurance, as opposed to them (27.7%) or a competitor (26%) falling victim of a cyberattack. While this shift makes businesses safer, SMEs may not always be able to afford the cost of a policy or the technology (such as software upgrades) required by insurers. Given the high barrier to entry for SMEs, insurers should focus on developing policies covering just the risks that are most common to such businesses.