GlobalData surveying found that over half of UK consumers want more women in boardrooms at insurance companies. Meanwhile, a survey by the Lloyd’s Market Association (LMA) found that a male-dominated leadership environment is the primary cause of decreasing female talent in the underwriting pipeline.

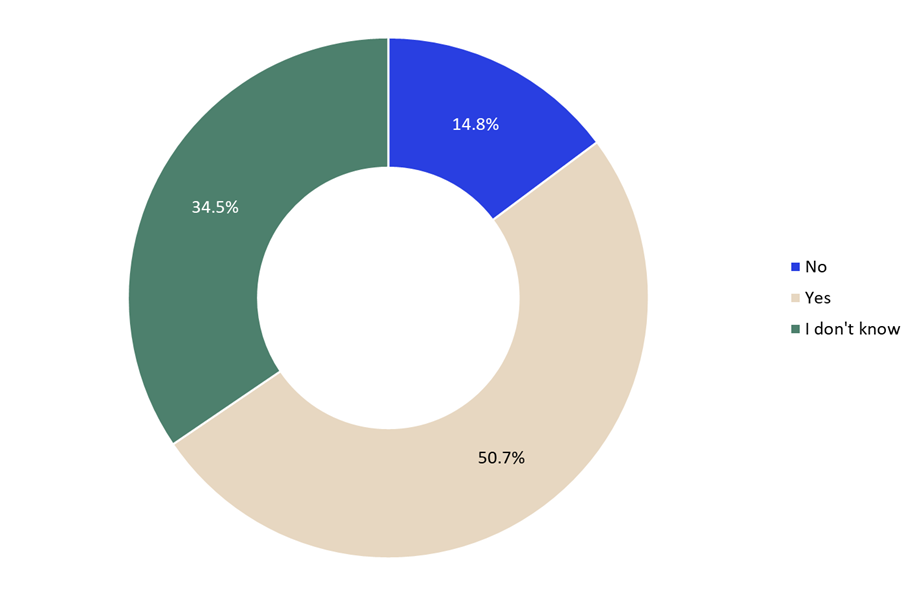

GlobalData’s 2024 UK Insurance Consumer Survey found that 50.7% of consumers would like to see more women in boardrooms at insurance companies. This suggests gender representation in senior leadership is a noticeable issue for consumers. It also indicates that boardroom composition is an area the public is paying increasing attention to within the insurance sector.

Would you like to see more women in boardrooms at insurance companies? 2024

Meanwhile, an LMA survey found that 52% of respondents in its London market snapshot cited a “male-dominated leadership environment, leading to a lack of inclusivity” as the primary reason for declining female talent in the underwriting pipeline. The survey—which gathered views from 128 female underwriters, chief executives, and chief underwriting officers—also highlighted that 42% faced challenges with work-life balance due to in-office expectations, travel, and social commitments. In addition, 27% of respondents pointed to the financial burden of caring responsibilities for children and parents as a further barrier to progression.

The findings from both surveys underline that gender representation and the experience of women within insurance leadership pipelines are receiving increasing attention. While consumers are signalling a desire for greater female presence in senior roles, female professionals within the market are simultaneously identifying the structural and cultural barriers that limit their progression.

Together, these insights point to a consistent theme: diversity challenges are being recognised externally by customers and internally by those working within the sector. With clear evidence of obstacles such as leadership culture, work-life balance pressures, and caring responsibilities, the data highlights specific areas that insurers may need to address to strengthen retention and advancement of female talent in underwriting and executive pathways.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData