Toyota’s new, fixed-premium, three-year car insurance policy in the UK is another sign of the rising embedded insurance trend and looks to target customers who have faced premium rises in recent years. Embedded insurance is selling relevant insurance straight to the customer at the point of sale, so for motor insurance it comes from car manufacturers. GlobalData’s 2024 Emerging Trends Insurance Consumer Survey found that car manufacturers was the most-likely threat to the current car insurance market out of all the alternative providers.

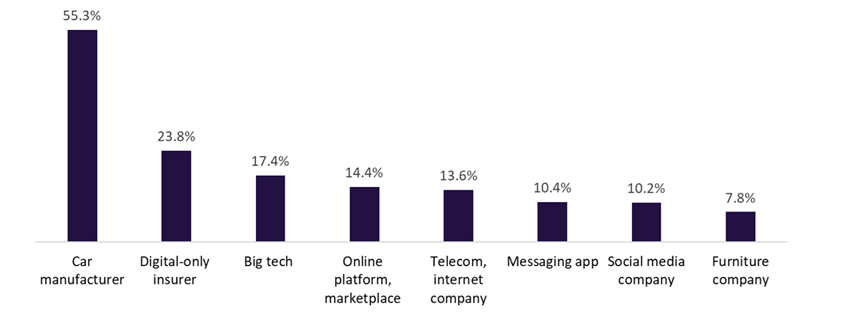

Consumers were significantly more likely to want to buy car insurance from a car manufacturer than from a digital-only insurer, big tech company, and other non-traditional insurers who have shown some intent to enter the market in recent years. Over half of the consumers in the UK were open to this possibility which highlights the scale of the opportunity for car manufacturers.

Have you bought or would you buy a car insurance policy from these types of companies if there were to offer it? 2024

Motor is one of the most-established products for the embedded insurance trend. It can be a threat to insurers, but car manufacturers usually have underwriting partners, so it is more a threat to the distribution channels. Insurers will need to be aware of the growing trend and ensure they are targeting suitable partnerships if they want to grow premiums. This Toyota policy appears particularly attractive due to its premium price lock in for three years.

GlobalData’s 2024 UK insurance Survey found that 81.3% of respondents said their premiums increased in the last year. 31.2% said that that increase had been by in excess of 20%. Consumers have been hit hard by inflation and the cost-of-living crisis in recent years so a three-year price lock in should provide peace of mind on that front. Overall, this should interest consumers due to its three-year premium guarantee and because car manufacturers, such as Toyota, are trusted by consumers to provide insurance.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData