Industry experts are increasingly acknowledging embedded insurance as a crucial factor for growth in the distribution of personal lines insurance over the next five years, a GlobalData poll has found. Insurers and brands that integrate cover at the point of sale will be best positioned to capitalise on this shift. This approach is now being demonstrated by Bentley Financial Services through its new insurance offering.

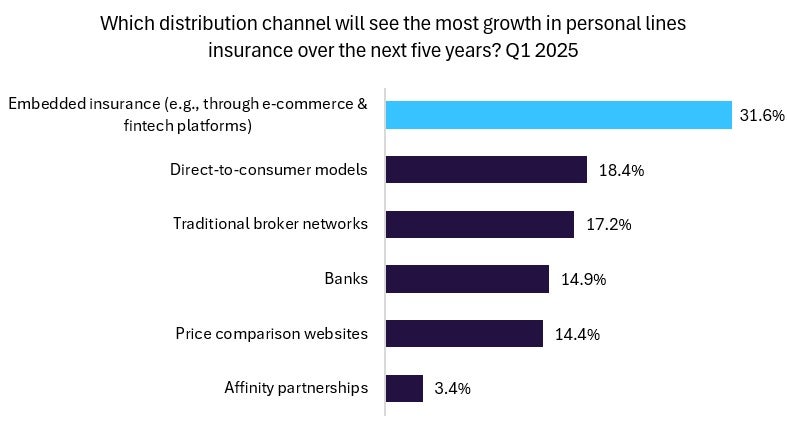

According to a poll conducted by GlobalData on Verdict Media sites in the first quarter of 2025, 31.6% of participants believe embedded insurance will see the most significant growth in this sector, far surpassing traditional distribution methods such as direct-to-consumer (18.4%) and conventional broking networks (17.2%).

Bentley Financial Services is introducing a new insurance product, which embodies the embedded insurance model within the luxury automotive sector. This customised insurance service is designed specifically for Bentley customers, covering both new and preowned Bentley vehicles. In collaboration with Chubb for underwriting and Carbon Insurance Brokers for administration and claims management, Bentley aims to deliver a seamless insurance experience that reflects its brand values.

The rollout of this insurance offering underscores the benefits of embedded insurance; allowing customers to secure coverage as part of their overall purchasing experience. By integrating insurance into the buying process, Bentley reduces the friction typically involved in obtaining separate coverage; thereby enhancing customer satisfaction and loyalty. According to a 2023 GlobalData poll, insurance insiders selected motor insurance as the insurance product which embedded insurance will disrupt the most. This strategic initiative not only streamlines the insurance acquisition process, but also positions Bentley to achieve higher conversion rates and strengthen brand loyalty among its customers.

In conclusion, Bentley’s entry into embedded insurance serves as an insightful example of how luxury brands can utilise this innovative distribution model to improve customer experience and drive growth in a competitive landscape.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData