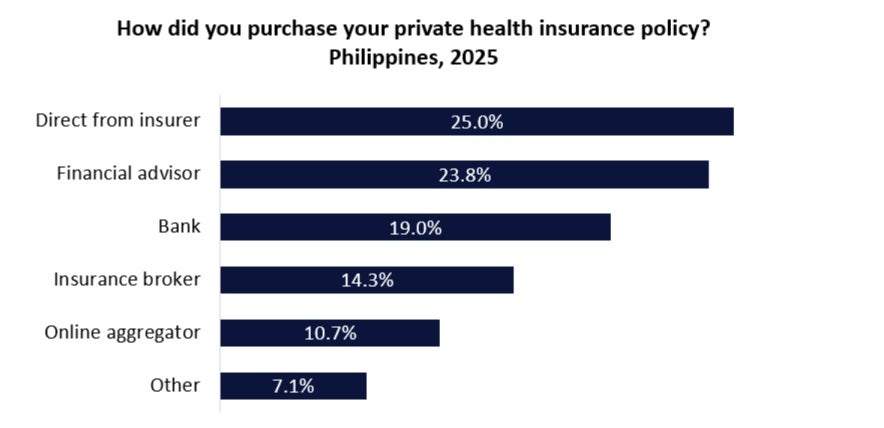

Medical expenses are spiralling in the Philippines yet most citizens face having to pay out-of-pocket for their treatments as most do not hold health insurance as per a GlobalData survey. There are good opportunities for medical insurers to introduce more adaptable healthcare plans as medical inflation is expected to remain high. According to GlobalData’s 2025 Financial Services Consumer Survey, only 33.9% of Filipinos hold private health insurance; leaving most consumers unprotected when it comes to medical treatments and expenses. Further findings from the survey reveal preferred purchasing methods, with one quarter of private health insurance policyholders buying their policy directly from the insurer, with this being closely followed by sales through financial advisors (23.8%).

While healthcare is available in the Philippines through the National Health Insurance Program (NHIP), the programme typically covers case rates for illnesses and procedures, meaning it only pays a fixed amount regardless of the actual cost. This can leave patients with a substantial balance to settle, especially when using private facilities. Private health insurance can complement NHIP; offering higher benefit limits for treatments, surgeries, and hospitalisations. Yet, healthcare expenses in the Philippines continue to escalate at double-digit rates, making health insurance an increasingly relevant product. WTW’s 2025 Global Medical Trends Survey anticipates healthcare costs in the Philippines will rise by 18.3% in 2025, making it one of the highest rates in the Asia-Pacific region. As such, there are good opportunities for healthcare insurance providers to expand their offering in the Philippines. One such example is Oona Insurance, headquartered in Singapore, which has recently rolled out two, new products. Global Shield targets Filipinos who are internationally mobile and offers coverage of up to $2m, whilst Purple Shield provides up to $86,000 and is intended for Filipino families seeking healthcare provision within the country. The products are available through Oona’s digital platform, which allows instant quotes, policy issuance on the same day of the application, and an online claims experience to speed up reimbursements. Going forward, the insurance industry will likely be on a fast-track to reach more cohorts of Filipinos. Online methods will be crucial in reaching vast numbers of consumers effectively, particularly given the propensity of consumers living in rural areas. Furthermore, purchasing directly from the insurer, which is not only the preferred method of Filipinos to purchase health insurance, but can result in more-favourable pricing by eliminating the middleman. Further data from GlobalData’s survey reveals that by far the largest proportion of citizens (73%) would prefer purchasing a new insurance product face to face and this would be the main challenge for digital-first insurers to tackle, who should look into building trust with consumers and ensuring a seamless customer experience.