Geopolitical conflict is the theme that will impact businesses the most in the next 12 months, a GlobalData poll has found. Meanwhile, Aon’s 2025 Global Risk Management Survey revealed that, for the first time in the survey’s 19-year history, geopolitical volatility entered the top ten global risks.

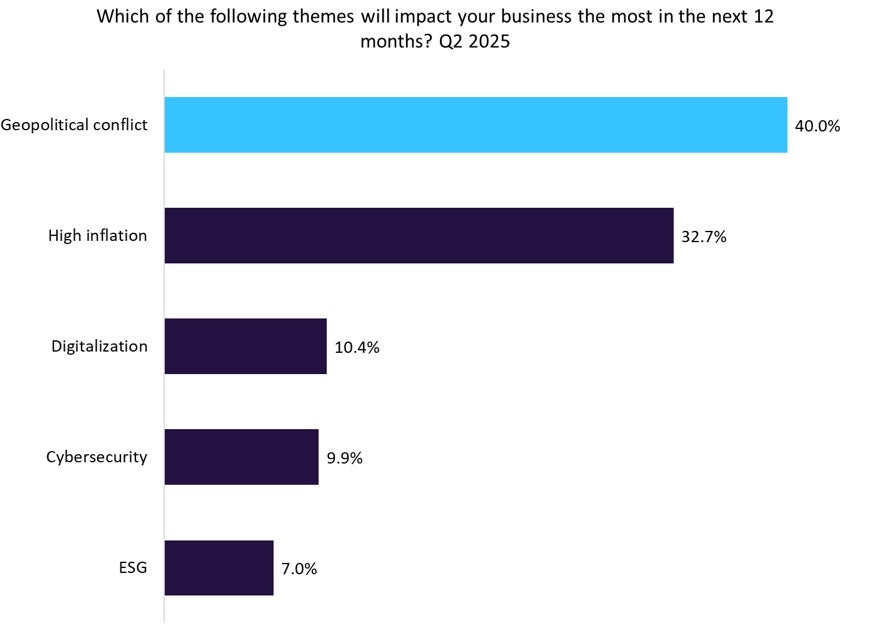

According to GlobalData’s second-quarter 2025 ESG Sentiment Poll, geopolitical conflict is viewed as the theme most likely to impact businesses over the next 12 months, with 40.0% of respondents selecting it as the most significant risk. This is notably higher than high inflation at 32.7%, digitalisation at 10.4%, and cybersecurity at 9.9%. The dominance of geopolitical tension reflects the widespread impact of ongoing conflicts and trade disputes, which are disrupting global supply chains, driving energy market volatility, and creating greater regulatory uncertainty for businesses.

Meanwhile, Aon has recently released its 2025 Global Risk Management Survey and for the first time in the survey’s 19-year history, geopolitical volatility entered the top ten global risks. The risk now sits alongside various issues such as business interruption, regulatory change, and economic slowdown, underscoring how interconnected global markets have become. Aon also found that only 14% of organisations track their exposure to their top risks and just 19% use analytics to measure the value of their insurance programmes; highlighting a significant gap between awareness and preparedness.

For insurers, the growing prominence of geopolitical risk presents both a challenge and an opportunity. Traditional insurance models are often ill-equipped to cover the complex and far-reaching consequences of political instability such as sanctions, supply chain disruptions or forced business closures in conflict zones. Insurers should therefore be expanding their use of scenario modelling and geopolitical risk mapping to better understand how regional tensions could cascade through global markets. Leveraging AI and predictive analytics can help underwriters identify exposure hotspots, quantify indirect losses, and adjust pricing models dynamically as situations evolve.

In addition, insurers should strengthen partnerships with risk intelligence providers and develop parametric or event-based products that can offer faster payouts in volatile environments. Such solutions would be particularly valuable for industries heavily exposed to trade disruption, energy dependence or cross-border operations. Finally, proactive client engagement will be key. Insurers can play a strategic advisory role by helping clients quantify their geopolitical exposure, stress-test their risk management frameworks, and integrate political risk mitigation into broader enterprise resilience plans. Those that invest in forward-looking risk assessment and flexible policy design will be better positioned to meet client needs in an increasingly unstable global landscape.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData