Nearly half of UK consumers are open to purchasing a travel insurance policy that pays out automatically, GlobalData surveying has found. At the same time, major airports—including Heathrow, Dublin, and Brussels—continue to face significant disruption following a cyber attack over the weekend.

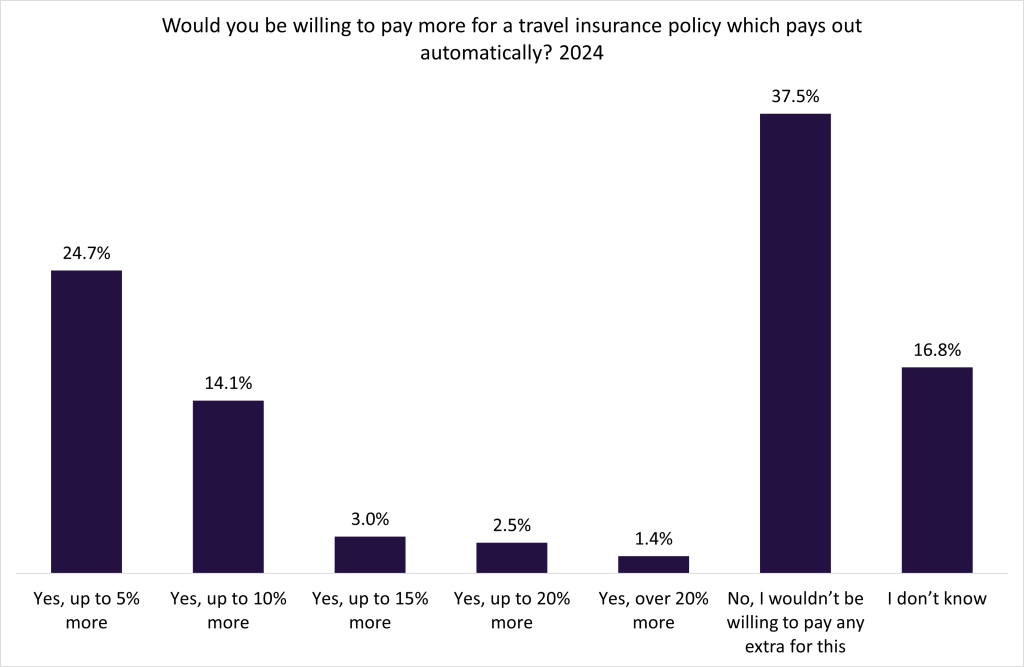

According to GlobalData’s 2024 UK Insurance Consumer Survey, 45.7% of UK consumers would be willing to pay more for a travel insurance policy that pays out automatically. Of these, 24.7% would accept an increase of up to 5%, while 14.1% would pay up to 10% more. In contrast, 37.5% said they would not be willing to pay extra and 16.8% were unsure.

The cyber attack across Heathrow, Dublin, Brussels and other European airports has led to dozens of flight cancellations, hundreds of delays, and long queues as staff were forced to rely on handwritten tags and manual redeployments. In such cases, parametric travel insurance can be especially valuable as it triggers automatic payouts when predefined events occur, such as delays or cancellations. This eliminates lengthy claims processes and provides travellers with faster financial relief during unexpected disruptions.

The incident also highlights the growing threat of cyber attacks across industries. As digital vulnerabilities continue to escalate, the need for robust protection is becoming more urgent. GlobalData’s 2025 UK Commercial Insurance Broker Survey found that 53.6% of brokers cited cyber insurance as the new or emerging product with the greatest growth potential; reflecting rising demand from businesses seeking to safeguard against operational and financial disruption.

For insurers, the disruption underscores the need to better promote parametric travel insurance as a solution for travellers facing mounting risks of cancellations and delays. At the same time, there is a growing need to position cyber insurance not just as financial protection, but as a preventative tool that enables airports, airlines, and other businesses to detect, mitigate, and respond to attacks more effectively. This dual focus highlights the importance of accelerating efforts to raise awareness and uptake of both parametric and cyber coverage; ensuring they are seen as essential safeguards for businesses and travellers navigating an increasingly-hostile digital environment.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData