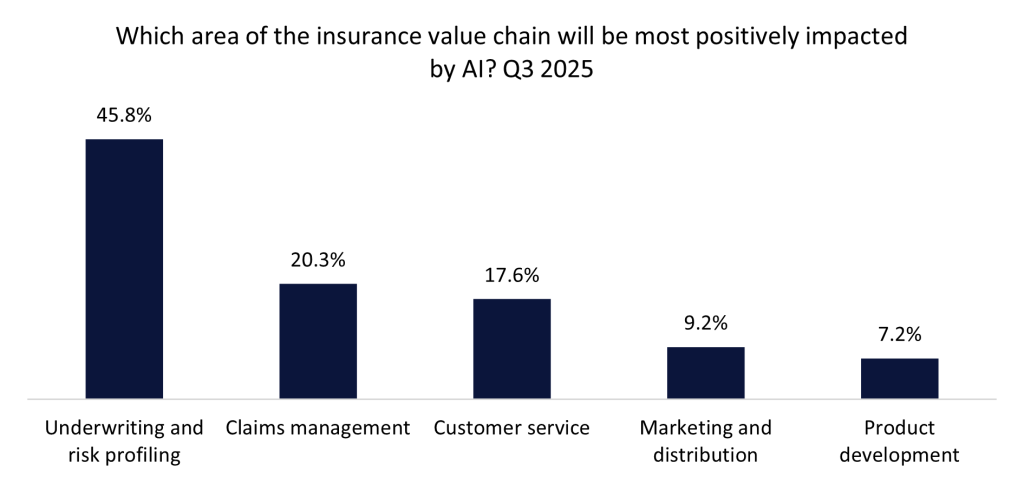

A 2025 poll conducted by GlobalData revealed that nearly 50% of respondents believe that underwriting and risk profiling will be the insurance value chain areas most positively impacted by AI over the next five years. Meanwhile, Allianz has launched BRIAN; a generative AI-powered tool designed to enhance efficiency and speed in its commercial underwriting operations.

The GlobalData poll, conducted in Q3 2025 on Verdict Media platforms, found that 45.8% of participants identified underwriting and risk profiling as the sectors within the insurance value chain most likely to benefit from AI. This reflects a confidence in AI’s potential to streamline decision-making processes and improve pricing accuracy.

Which area of the insurance value chain will be most positively impacted by AI? Q3 2025

Following a successful pilot phase that involved nearly 3,000 questions from 190 users, Allianz’s BRIAN is now fully operational and has been rolled out to additional underwriting teams. The tool has saved approximately 135 working days in information gathering since it was rolled out in January 2025; demonstrating its capability to provide accurate and consistent responses which free up valuable underwriting resources. This is particularly beneficial for junior underwriters as it accelerates their learning and fosters consistency in decision-making across the organization.

The implementation of BRIAN illustrates how AI can alleviate the burdens of traditionally manual processes; enabling underwriters to concentrate on higher-value tasks, such as risk analysis, pricing refinement, and relationship management. Going forward, other insurers should consider experimenting with AI in high-impact areas of the value chain. By piloting new tools, measuring productivity gains, and scaling successful solutions, they can maintain competitiveness as AI becomes an increasingly-vital differentiator in underwriting and customer service.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData