GlobalData research shows that younger consumers in the UK are more likely to hold pay-as-you-go (PAYG) or usage-based (UBI) car insurance policies. However, the latest Consumer Intelligence Car Insurance Price Index indicates that this group is facing rising premiums, with reports suggesting telematics providers are becoming less willing to offer competitive rates to younger drivers.

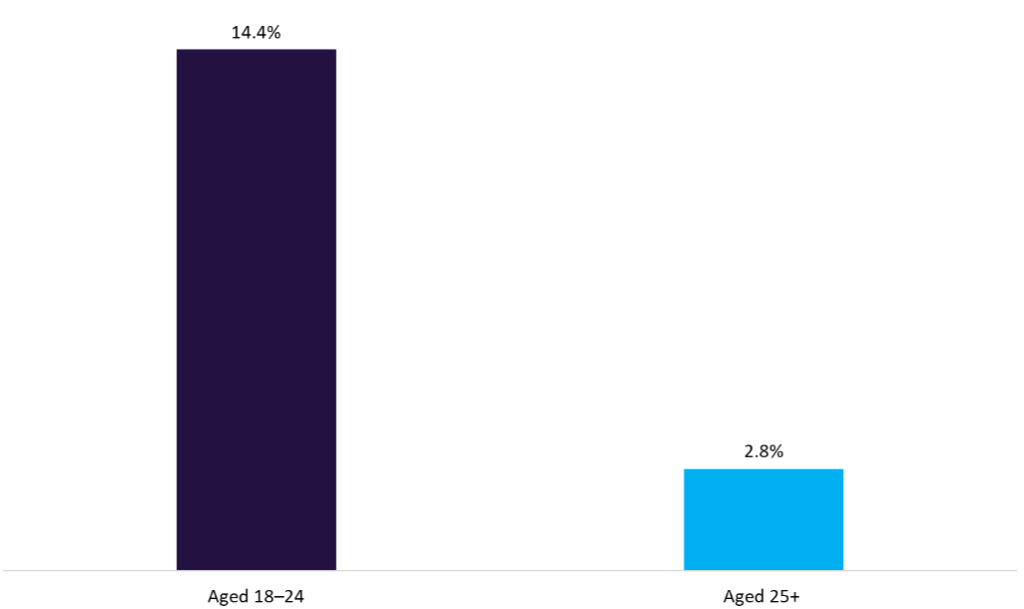

GlobalData’s 2024 UK Insurance Consumer Survey shows that 14.4% of consumers aged 18 to 24 have a PAYG or UBI car insurance policy. This is significantly higher than the 2.8% of consumers aged 25 and over. The findings highlight the stronger appeal of telematics and flexible insurance models among younger drivers, who tend to be more cost-conscious and open to alternatives to traditional policies. By contrast, uptake among older consumers remains very limited.

UK drivers with PAYG/UBI car insurance policies by age group, 2024

Meanwhile, the latest Consumer Intelligence Car Insurance Price Index shows that quoted premiums in the UK have fallen by 10.5% over the past year. However, drivers under the age of 25 have experienced the opposite trend, with premiums rising by 3% in Q2 2025, while the overall market recorded a 1.4% decline. The data highlights that the sharpest increases are being felt by drivers aged 17 to 19. At the same time, telematics providers that monitor driving behaviour appear to be showing less appetite for offering competitive rates to this group.

Despite younger drivers facing rising premiums and reports that telematics providers are showing less interest in offering competitive rates to this group, they remain more likely and more willing to engage with this technology. Insurers should recognise this openness by continuing to invest in telematics propositions tailored to younger consumers. Doing so can help strengthen brand loyalty, improve risk assessment through data-driven insights, and position insurers to capture long-term value from this segment as their insurance needs evolve.

Overall, the findings suggest that younger drivers remain a key audience for telematics and UBI. While younger customers continue to face challenges around affordability and limited competitiveness in pricing, their willingness to adopt new models highlights an opportunity for insurers to adapt their propositions and build stronger, long-term relationships with this segment.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData