The majority of UK SMEs are comfortable with AI assessing their insurance needs and recommending the most suitable coverage options, according to GlobalData surveying. Meanwhile, AI-native insurance broker Meshed has secured backing from Aviva and other investors, with the aim of reshaping the commercial insurance market for SMEs.

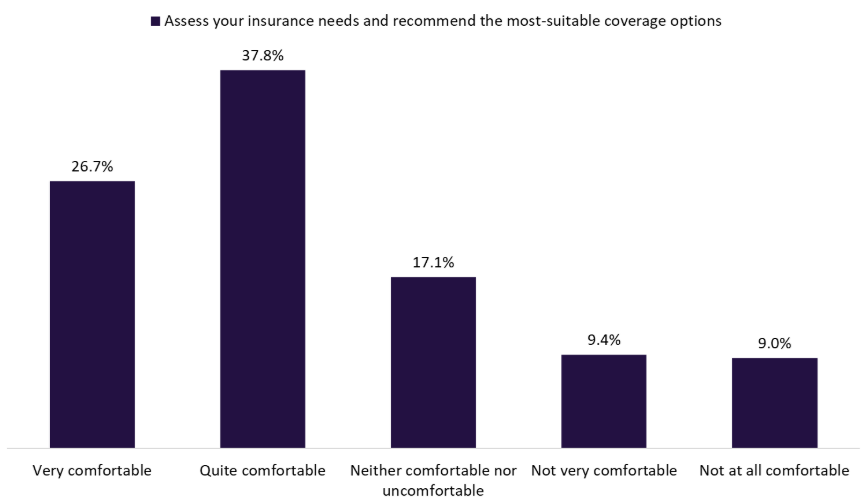

GlobalData’s 2025 UK SME Insurance Survey has found that 64.5% of SMEs are comfortable, to some extent, with AI assessing their insurance needs and recommending the most suitable coverage options. Moreover, over a quarter of SMEs (26.7%) cited that they were extremely comfortable with this.

How comfortable are you/would you be for an AI tool to do the following? 2025

Meanwhile, Meshed has raised £950,000 ($1.3m) in an oversubscribed pre-seed funding round to transform the commercial insurance market for SMEs. Investors included Haatch, Aviva via Founders Factory, the Exponential Science Foundation, and several angel backers. Meshed highlights that around 80% of UK SMEs remain underinsured, largely due to outdated brokerage practices and inefficient manual processes. By deploying AI-powered agents for quoting, data collection, and other routine tasks, the firm aims to cut administrative costs, reduce premiums, and enable brokers to focus more on client relationships and specialist advice.

Yet, findings from our 2025 UK Commercial Insurance Broker Survey indicate that brokers may be underestimating the scale of disruption that AI could bring. Only 5.2% of brokers see AI as the biggest threat to their business, compared with 13.2% citing competition from other brokers and 11.2% from direct players. Moreover, adoption remains limited, with just 5.9% of brokers using AI-driven policy recommendation tools, while 78.6% report no plans to adopt them.

Brokers should recognize that while AI may not seem like the greatest threat today, failing to adopt it could make it one tomorrow. By overlooking AI, brokers risk falling behind faster-moving competitors and losing relevance in a market where efficiency and digital capabilities increasingly drive client expectations.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData