A significant proportion (41.9%) of insurance business insiders believe it is crucial for insurers to offer ‘green’ or environmentally friendly insurance products or services, according to a GlobalData poll. Meanwhile, further surveying from GlobalData reveals most consumers would be willing to pay more for an insurance policy from an insurer with strong ethical, sustainable, and environmentally friendly commitments.

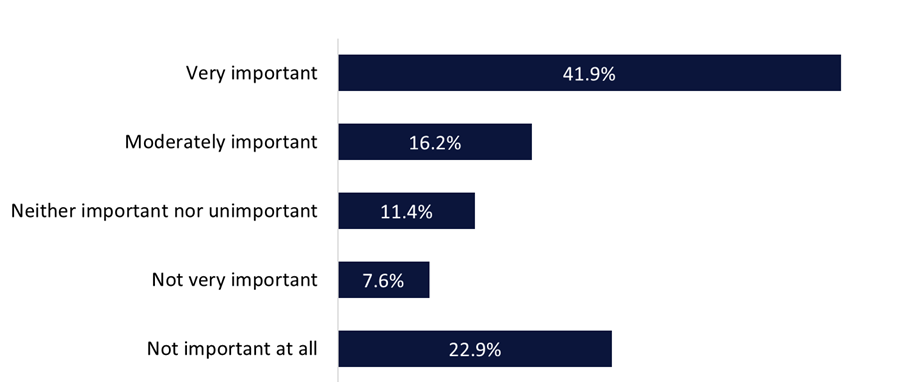

According to a poll conducted by GlobalData on Verdict Media sites in Q3 2025, which garnered over 100 responses from industry insiders, 41.9% of business executives cited that it was very important to offer green insurance products or services, while a further 16.2% viewed it as moderately important. The challenges posed by climate change have led to the emergence of green or sustainable insurance, encompassing products and practices that integrate environmental, social, and governance (ESG) factors into the value chain. Despite this, 30.5% of insiders view offering green products as unessential, meaning they risk falling behind the curve of the development of new products.

How important is it for insurance companies to offer “green” or environmentally friendly insurance products or services? Q3 2025

Consumer awareness about environmental issues has increased, with many now expecting to see eco-friendly options, including in insurance. Findings from GlobalData’s 2024 Emerging Trends Insurance Consumer Survey highlight this, with 51.3% of respondents citing insurance companies have a role to play in tackling climate change, compared to the 28.1% who did not think so, while a further 20.6% were unsure. In fact, the survey also reveals that 59.1% of consumers would be willing to pay more for an insurance policy if they knew the company had strong ethical, sustainable, and environmentally friendly commitments, compared to the 34.1% who were unwilling to do so. 29.6% of consumers would be willing to pay up to 5% more for such a policy.

Besides growing consumer demand, there are further reasons why insurers should offer green products, such as to mitigate risks. Climate change is leading to more frequent weather events and natural disasters such as wildfires, floods, and tsunamis, which are resulting in higher claims. Insurers can offer green products in a bid to mitigate climate-related risks. For instance, insurers can offer discounts for energy-efficient homes and cars, as well as sustainable building materials to mitigate the impact of climate change.

Moreover, governments and regulatory bodies are increasingly implementing regulations that require businesses—including insurers—to adopt ESG practices, as well as making disclosures. Finally, insurers who can demonstrate environmental commitments will enhance their brand reputation and improve trust among consumers, which will in turn help them to position themselves as a forward-thinking and responsible organisation, while also potentially enabling them to charge more for their products.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData