A GlobalData survey has found that more than half of UK commercial brokers believe cyber insurance is the product that has the most growth potential in the commercial insurance industry. This reflects growing awareness of cyber threats and heightened risk perceptions among businesses, both of which are driving demand—even though adoption of cyber cover is not yet universal.

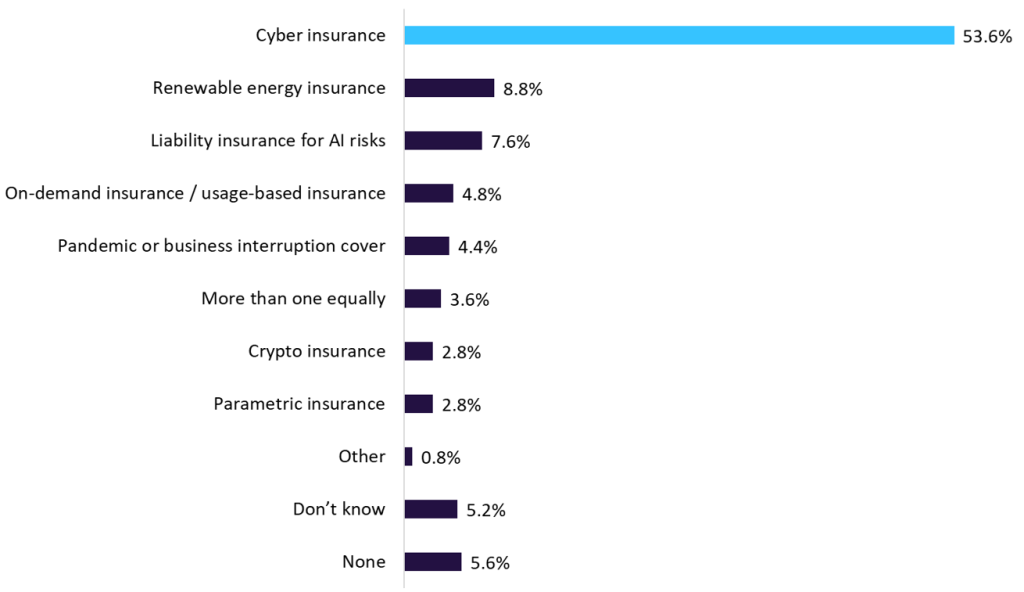

According to GlobalData’s 2025 UK Commercial Insurance Broker Survey, cyber insurance stands out as the product with the greatest potential for growth. More than half of the brokers surveyed (53.6%) selected it as the most promising emerging product, well ahead of other areas such as renewable energy insurance (8.8%) and cover for AI-related liabilities (7.6%). The scale of this gap suggests the market sees cyber threats as a key area where insurance demand will rise sharply. This growing demand is being further fuelled by heightened awareness among businesses and the frequent reporting of cyberattacks in the media.

Which new or emerging commercial insurance product do you see as having the most growth potential? 2025

GlobalData’s findings are backed by recent data from QBE Insurance Group. Its 2024 report showed that the number of cyberattacks more than doubled compared to the year before, rising by 104%. It also found that a large majority of IT decision makers (78%) were worried about the cyber threats facing their organisations in the year ahead. These findings echo sentiments from brokers and point to a growing sense of urgency among businesses to strengthen their digital risk management.

Despite this, many businesses still have not taken out cyber insurance. While awareness is clearly increasing, this has not yet translated into widespread adoption. GlobalData’s 2025 UK SME Insurance Survey found that just 40.2% of small- and medium-sized enterprises (SMEs) have cyber insurance. This gap between concern and action represents a major opportunity for brokers, particularly in the SME space. Smaller companies are often more vulnerable to attack but have fewer resources to respond effectively, making them strong candidates for tailored cover.

If uptake is to grow, insurers will need to focus on making products easier to understand and more relevant to different types of businesses. There remains confusion around what cyber insurance actually covers, especially when it comes to situations such as downtime, data breaches, and regulatory penalties. Building clearer policies and offering straightforward advice could be key to helping more companies feel confident in taking out protection.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData