Fewer than half of low-income individuals in the US have private health insurance as per a GlobalData survey. Trump’s politics bring uncertainties to the pharmaceutical industry, which will likely translate into higher health insurer rates for consumers; potentially pricing out Americans with lower disposable income, while leaving others underinsured.

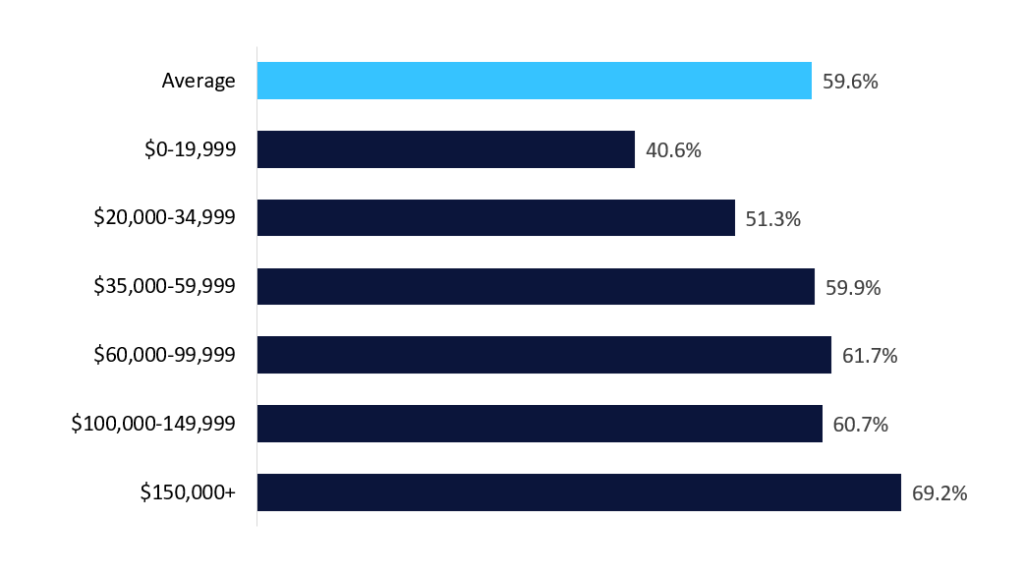

The US has an insurance-based system when it comes to medical access. According to GlobalData’s 2024 Financial Services Consumer Survey, 59.6% of US consumers hold private health insurance. Private health insurance premiums can be substantial and there is a strong correlation between product holding and disposable income. Lower-income individuals are less likely to be able to afford private health insurance, with product holding falling to 40.6% among individuals in household incomes under $20,000. Meanwhile, they would also face having to pay out of pocket for their medical expenses; potentially leading to financial strain which pushes them into debt or simply not being able to afford the medical care they need.

Private health insurance penetration rates among US consumers, by annual household income, 2024

The US pharmaceutical industry has so far escaped Trump’s tariffs, which have otherwise been imposed—although implementation has been delayed—in a plethora of industries. Yet, the threat is there, with Trump indicating he may impose tariffs on pharmaceutical imports, which would make medications and hospital treatments more expensive. EY estimates that imposing a 25% tariff on pharmaceutical imports could raise medication prices up by 12.9% if the increased production costs were passed onto patients. Moreover, an increase in drug costs will also mean that patients could potentially hit their insurance limits sooner which increases the risk of underinsurance. Americans may find themselves in a situation where their insurer refuses to cover the full cost of treatment; leaving them to pay for some of the costs, which may not be financially viable for all. Cancer patients will be particularly vulnerable to price increases due to the cost and length of treatments.

Private health insurers are also expected to hike premium rates; driven by the prospects of medical claim inflation and future uncertainty of the drug market. This would result in a fall in health insurance penetration rates as more consumers become priced out, particularly those in lower-income households.

Reportedly, several drugmakers—including AstraZeneca, Roche, and Novartis—will either shift some of their drug production to the US or invest in new facilities altogether to avoid the looming tariffs. However, establishing domestic production capacity can be costly and time consuming. While domestic production may help ease concerns of supply chain issues and would avoid any tariffs imposed, the capital expenses incurred by pharmaceutical companies would likely also result in higher prices of medications as some of those costs are passed onto consumers.

Despite threats on US tariffs on pharmaceuticals, Trump said he wants to “equalise” or bring down drug prices in the US to the level of other countries. In this respect, the President signed an executive order to reduce the price of prescription drugs. If these materialised, it would exert downward pressure on private health insurance rates. However, the news has been received with scepticism, with experts believing the order would have no immediate effects.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOverall, Trump’s policies bring uncertainties about the future of the private health insurance market. This entices a climate where insurers are likely to respond by increasing premium rates and could even limit coverage of certain medications. Under such circumstances, underinsurance may become a real possibility, while other Americans could be priced out and may be forced to forego cover altogether.

Navigate the shifting tariff landscape with real-time data and market-leading analysis. Request a free demo for GlobalData’s Strategic Intelligence here.