COVID-19 has sparked high demand for income protection products as fears of job losses and mass redundancies have mounted. But wary insurers have temporarily withdrawn unemployment cover from the market, which will lead to a sharp fall in premiums.

GlobalData’s upcoming UK Protection Insurance 2020: Income Protection report anticipates that the individual income protection market will plunge by 26.5% in 2020, with new business premiums set to fall to £48.2m, down from £65.5m in 2019. While demand for unemployment income protection policies soared at the outset of the pandemic, insurers quickly stopped selling these products over an uncertain economy and the prospect of high unemployment.

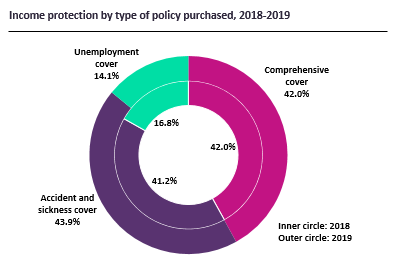

It is estimated that more than half of all income protection products sold provide unemployment cover. According to GlobalData’s 2019 UK Insurance Consumer Survey, 56.1% of consumers purchasing income protection bought policies providing cover against redundancy – either unemployment insurance or comprehensive income protection. The latter, in addition to providing unemployment cover, also provides protection if the policyholder becomes incapacitated to work because of sickness or an accident.

It is still possible to purchase income protection that provides long-term accident and sickness cover. However, some insurers have introduced COVID-19 exclusions on new policies, as is the case with British Friendly, for instance. Some individuals may buy these policies being unaware that they do not provide cover against job losses – given the strong growth of the unadvised channel in recent years – or merely as an alternative to comprehensive cover, but any shift towards accident and sickness cover will not suffice to prevent the income protection market from shrinking in 2020.

On a more positive note, GlobalData’s report anticipates that the income protection market will bounce back in 2021 and sustain growth to 2024 as the impact of the pandemic is left behind. COVID-19 will trigger appetite for income protection products in the medium to longer term and raise awareness of the benefits they provide. In addition, individuals will become more wary about unprecedented events and will rethink how best to protect themselves against them. These factors are expected to contribute to future growth of the income protection market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData