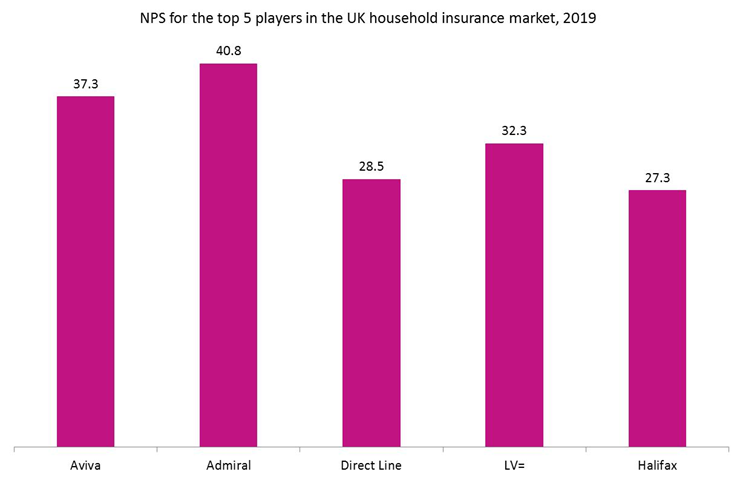

AXA intends to focus on better supporting start-ups and SMEs in the next two to three years and our broker survey results suggest it needs to show improvements in order to compete with Aviva for SME attention.

The two players lead the SME insurance market in the UK, with AXA holding a share of 7.8% and Aviva 7.6%, and with a two-percentage-point gap to the third largest insurer, according to our 2019 SME Insurance Survey. Despite AXA’s slender lead over Aviva, our 2019 UK Broker survey indicates that Aviva currently offers better service to SMEs and start-ups across a range of categories.

The figure above shows that Aviva is particularly dominant in digital services, in the form of its extranet and e-trading sites, as well as its ability to offer online support. However, the categories in which AXA is more competitive with Aviva are in the customer services areas (claims service, relationship managers, and partnering on a new scheme).

Therefore, if it is looking to standout in these service areas, it has an easier task of standing out ahead of Aviva and other competitors than it does in the more digital categories.

A further positive would be AXA’s strong performance in the SME market despite its offerings lagging behind Aviva, according to brokers. This suggests that it is aware of its perception within the market and that it could consolidate its leading position if its refocusing over the next couple of years is successful.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData