Young drivers in the UK face much higher car insurance premiums due to their inexperience and riskier behaviour. Price comparison websites (PCWs) are therefore much more popular among young drivers as they endeavour to get the best deal possible – but things are not as straightforward as they seem.

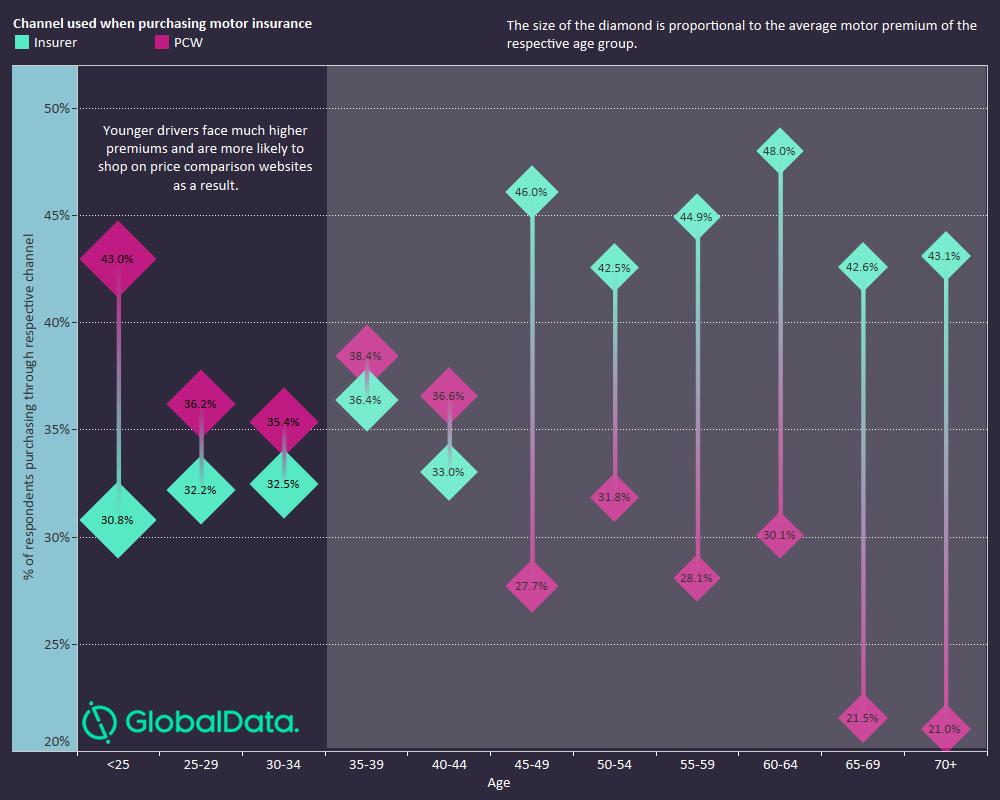

According to GlobalData’s 2019 UK consumer survey, purchasing directly from a provider is the most common motor insurance channel, accounting for 39.3% of all purchases, with a PCW being the second most popular (31.3%). However, looking at purchasing channel preferences among age groups, the PCW is the most popular channel among younger drivers.

As highlighted by the above chart, PCWs are more popular among drivers under 45 years of age, while older drivers prefer to purchase directly from a provider. The chart also highlights that younger drivers face much higher premiums compared to older drivers, which is likely to be the main factor driving them towards PCWs.

However, GlobalData research revealed that the prices on various PCWs are extremely varied. For example, a policy from a leading motor insurer in the UK was quoted as £248.64 per year. Using an identical profile on a different PCW, the policy quoted from the same provider stood at £614.88.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis highlights that consumers may not necessarily receive the best price when shopping on PCWs. Drivers should therefore invest additional time when shopping for motor insurance to ensure they receive the best deal. This is especially important for young drivers, as any penny saved on their high premiums will be appreciated.