The insurance industry continues to be a hotbed of patent innovation. Activity is driven by digitalization, personalization, and growing importance of technologies such as artificial intelligence (AI), Internet of Things, and cybersecurity in insurance documentation and data analytics, predictive risk assessment, fraud detection, and smart policy management. In the last three years alone, there have been over 17,000 patents filed and granted in the insurance industry, according to GlobalData’s report on Artificial intelligence in insurance: smart vehicle damage assessment. Buy the report here.

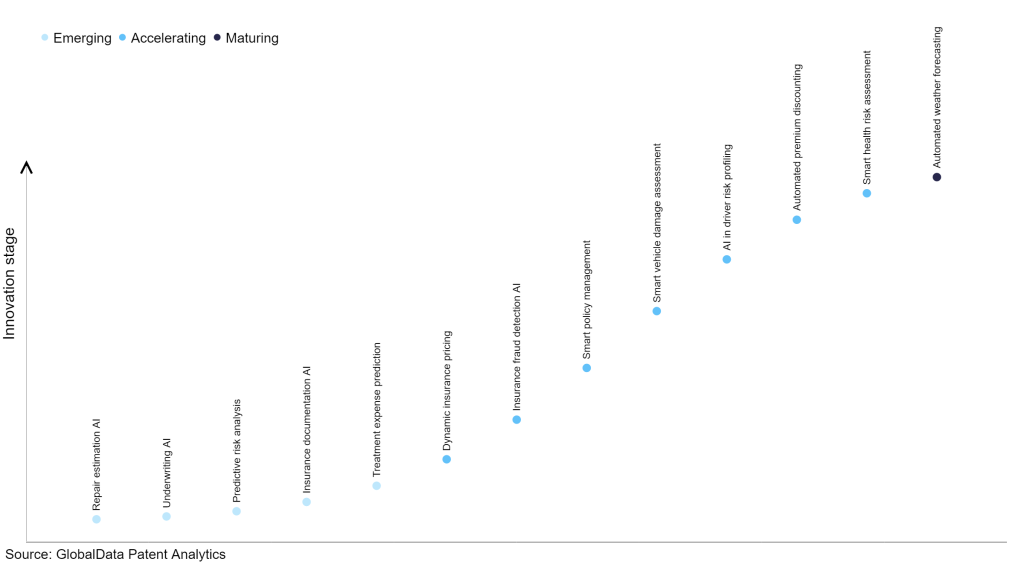

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

20+ innovations will shape the insurance industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the insurance industry using innovation intensity models built on over 70,000 patents, there are 20+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, underwriting AI, predictive risk analysis, and insurance documentation AI are disruptive technologies that are in the early stages of application and should be tracked closely. Insurance fraud detection AI, smart policy management, and smart vehicle damage assessment are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas is automated weather forecasting, which is now well established in the industry.

Innovation S-curve for artificial intelligence in the insurance industry

Smart vehicle damage assessment is a key innovation area in artificial intelligence

Smart vehicle damage assessment refers to the use of advanced AI technologies such as image processing, computer vision, and machine learning to automatically assess and estimate the repair cost of damaged vehicles. By analyzing images of the damaged vehicle, both external and internal damage can be detected and inferred by insurers, allowing for a more accurate estimation of repair costs. This technology aims to streamline and automate the process of vehicle damage claims, thereby reducing manual effort and improving the efficiency of insurers.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 150+ companies, spanning technology vendors, established insurance companies, and up-and-coming start-ups engaged in the development and application of smart vehicle damage assessment.

Key players in smart vehicle damage assessment – a disruptive innovation in the insurance industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to smart vehicle damage assessment

Source: GlobalData Patent Analytics

State Farm Mutual Automobile Insurance is one of the leading patent filers in smart vehicle damage assessment. The company filed patents related to machine learning and deep learning image processing techniques for automatically estimating the damage level, repair time, and repair cost for vehicles involved in an accident. Cox Enterprises, Alibaba Group, and Ping An Insurance (Group) are some of the other key patent filers in the smart vehicle damage assessment space.

In terms of application diversity, Theator held the top position, while Curiteva and Clearlake Capital stood in second and third positions, respectively. By means of geographic reach, Alphabet leads the pack, followed by Pictometry International and Clearlake Capital.

To further understand the key themes and technologies disrupting the insurance industry, access GlobalData’s latest thematic research report on Artificial Intelligence (AI) in Insurance.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.