All articles by GlobalData Financial

GlobalData Financial

Demand for flood insurance soars in the US

The significant demand for flood coverage in the US and beyond indicates that insurers willing to offer it will be able to increase retention and penetration rates.

Trump tariffs to drive US car insurance costs even higher

GlobalData’s 2024 Emerging Trends Insurance Consumer Survey reveals that 53.5% of US consumers pay over $1,000 annually for car insurance.

Rising pressure from customers is driving demand for environmental insurance products

Amid growing ESG concerns, more companies will look at environmental insurance to protect themselves against the risk that their activities will damage the environment.

Insurers must tackle the growing threat of political violence and terrorism

As geopolitical tensions escalate globally, businesses are increasingly exposed to these risks, necessitating a proactive approach to public protection measures.

China is leading in EV insurance uptake

With China’s EV sector continuing to expand, insurers operating in the country are well placed to capitalise on rising policy demand.

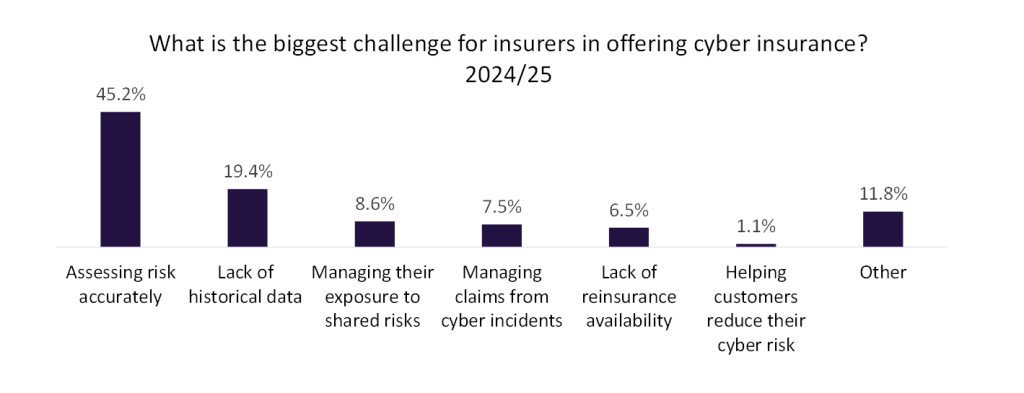

Controlling risk is still the biggest concern for insurers with cyber insurance

A GlobalData poll conducted across Verdict Media sites in Q4 2024 and Q1 2025 found that assessing risk accurately was the biggest concern among industry insiders in offering cyber insurance.

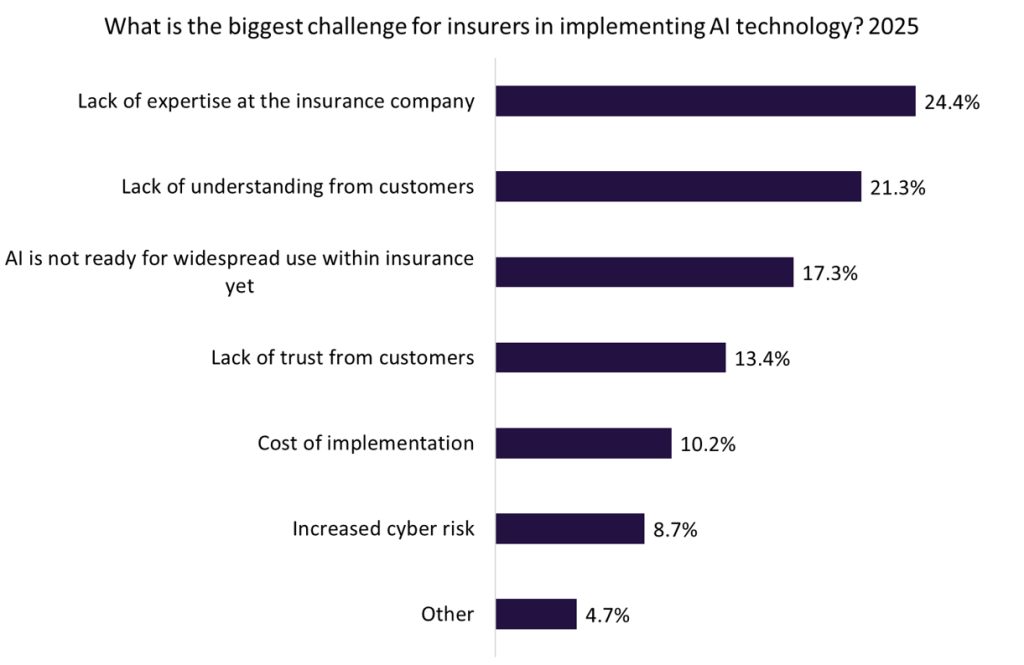

Lack of expertise is biggest challenge for insurers in implementing AI

To bridge the customer knowledge gap and build trust, insurers should focus on transparency and clear communication regarding AI-driven decision-making.

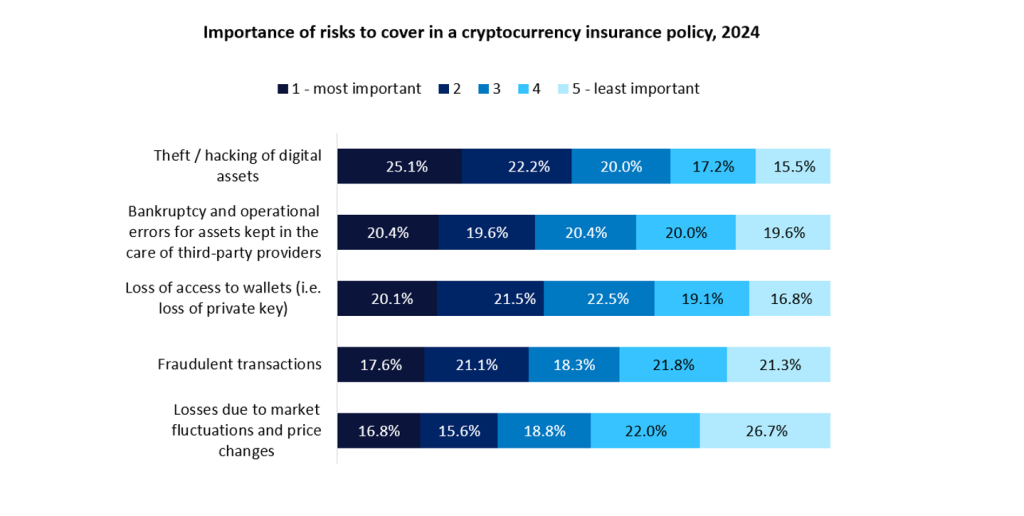

Strong appetite for crypto insurance as digital assets become increasingly popular

Cryptocurrencies are also largely unregulated and highly volatile. Consequently, insurers continue to view crypto insurance as a highly risky product.

Desirability of flood insurance is high in the US as weather events worsen

As climate change worsens the frequency and severity of weather events and natural disasters, insurers are losing appetite to provide cover for certain risks.

UK brokers believe there is a talent crisis in the insurance industry

A survey conducted by Ecclesiastical among 250 UK brokers found that 56% of respondents believe the industry is facing a potential talent crisis.