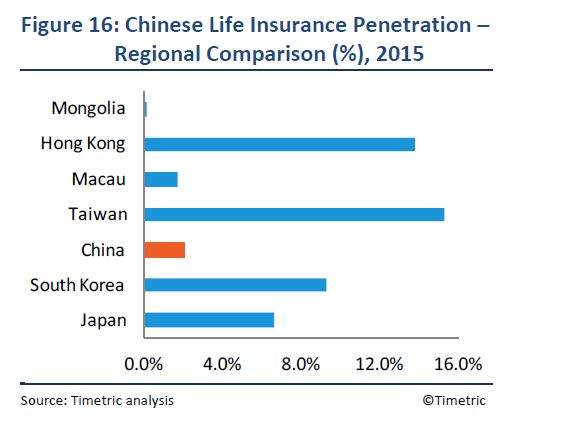

The gross written premium of China’s life insurance market is forecast to grow significantly from CNY1.4trn ($228.4bn) in 2015 to CNY2.5 trn in 2020, according to Timetric’s Insurance Intelligence Center (IIC)

A report Life Insurance in China, Key Trends and Opportunities to 2020, which is available at the IIC, explains that liberalisation initiatives and favourable economic and demographic factors will be key drivers for this growth.

In terms of favourable economic and demographic factors, China has the world’s largest population, with 1.39bn in 2016; the population is still growing and is estimated to reach 1.53bn at the end of 2025.

In 2016, the IIC says the Chinese working-age population accounted for 72.6% of the total population, providing a huge potential customer base for life insurers.

The Chinese population aged 65 years and above accounted for 10.3% of the total population in 2016, and is expected to increase to 14.2% by 2025 with 144m people.

Aging population

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataA rise in the aging population is expected to increase the uptake of long-term savings and investment-related products, especially pension and retirement plans, which created significant demand during 2011-2015, a trend that is expected to continue between 2015-2020.

Chinese life expectancy rose from 73.6 years in 2005 to 75.4 years in 2015, and is expected to reach 76.9 years in 2025. Life expectancy and the aged population in China are key parameters used to set life premium rates. As both factors are likely to increase over forecast-period, they will drive demand for pension and private retirement policies.

The CIRC has liberalized the life segment in three areas; a market-oriented guaranteed policy returns rate, relaxed investment restrictions, and easing the expansion of agencies and allowing online distribution. The CIRC has also issued regulatory measures to ensure stable and sustainable growth.

During 2011-2015, the CIRC liberalised the life segment with an objective to return policy-pricing power to insurers, encourage more competition and establish market-driven product development.

The CIRC increased the guaranteed interest-return cap from 2.5% to 3.5% for traditional products in August 2013, for universal products in February 2015, and for participating products in October 2015.

Insurers are allowed to offer products with returns higher than 3.5%, after receiving CIRC approval, making products more attractive. However, for universal products the cap was reduced to 3% in September 2016, to prevent insurers from offering abnormally high returns.

Liberalization benefits

The IIC report notes that liberalization and allowing insurers to offer market-oriented guaranteed return rates will drive growth and increase competition among insurers, leading to product development and new product launches.

Distribution channel outlook

Agencies have traditionally been the dominant distribution channel for life insurers in China primarily due to their large client base, strong brand reputation and low-cost sales force, making the agency network the most efficient way to promote and manage insurance products.

Some agencies have started online distribution, introducing digital platform to boost sales. For example, the Huize insurance business platform and Xin-YiZhan Insurance Agency offer online products and claims processing. In 2015, agencies accounted for 44.9% of new business direct written premium.

Bancassurance is the second-largest distribution channel for Chinese life insurers, accounting for 39.4% of the new business gross written premium in 2015. The main product classes sold through bancassurance include investment-related life insurance, retirement savings and critical illness life cover. Bancassurance is still less developed in terms of bank participation and product diversification than in developed markets such as the US, Japan and the UK.

Competitive landscape

At the end of 2016, the Chinese insurance industry consisted of 394 insurance undertakings, including 81 life insurers, 80 non-life insurers, 10 reinsurers, 44 insurance-asset management companies and 144 intermediaries.

Of the 81 life insurers, 53 were domestic-owned and 28 were foreign-invested. At the end of 2015, domestic insurers accounted for 93% of the new business written premium; foreign insurers contributed 7%.

High entry barriers

Despite expected growth in the life segment, the IIC says new entrants will find it challenging to establish viable distribution networks capable of competing with larger insurers with vast networks.

New entrants will also require resources for risk management and regulatory compliance, making operational entry barriers high.

Thus, new entrants and smaller insurers are expected to adopt e-commerce and online marketing as their primary distribution channels. During 2011-2015 the IIC noted that the number of insurers offering online products rose from 28 in 2011 to 117 in 2015, and it is expected to increase between 2015 and 2020.

The CIRC has set high regulatory barriers. There is a lengthy process for new entrants, and new branch licenses are issued on province-by-province basis. Foreign insurers are required to form joint ventures with local insurers to operate in China, and in December 2016 the CIRC proposed the lowering of the single stockholder limit from 51% to 33%. In 2016, the CIRC implemented Integrated Risk Rating and Solvency Aligned Risk Management Requirements and Assessment, and by the end of 2018 two major revisions in accounting standards in the form of International Financial Reporting Standards (IFRS)-9 and IFRS-17 are expected.

The CIRC has also announced plans to implement C-ROSS Phase II. These measures are expected to lower the number of new entrants between 2015 and 2020, and lead to consolidation.

The CIRC issued 13 new licenses in 2015, and eight in 2016. As of December 2016, around 80 entities had applied for entry in life insurance segment

For more information on Timetric’s Insurance Intelligence Center, visit